About the Strategy

Learn more about the National Financial Literacy Strategy and its establishment process, goals, committees and contents, including the roadmap for implementing the strategy.

Improving financial education and financial literacy

In Autumn 2021, the National Financial Literacy Strategy for Austria was launched. The goal is to increase the awareness for the importance of the topic, financial literacy and the understanding of citizens in the area of financial education.

Increasing complexity of the financial marketplace and financial products, rapidly advancing digitalisation and recurring fraudulent incidents in the financial services sector require an ever increasing level of financial education and financial literacy. Financial education enables us to make informed decisions in daily consumption issues. This makes it possible to deal responsibly with the personally available budget and with provision (financial planning for the future) and savings products. Awareness of the risks and opportunities of financial products and different forms of financing, as well as of the effects of debt, make a significant contribution to the personal and overall prosperity and well-being of a society.

The National Financial Literacy Strategy for Austria sets common and uniform objectives for stakeholders in the area of financial education, but also creates improved channels for the exchange of information. It is particularly important to approach the topic of financial education together in order to avoid duplication, to use synergies and to be able to achieve the best possible results.

The strategy document of the National Financial Literacy Strategy is available in German and English:

- Strategy in German (PDF, 1 MB) (PDF, 1 MB) (PDF, 1 MB)

- Strategy in Englisch (PDF, 1 MB) (PDF, 1 MB) (PDF, 1 MB)

The Development of the National Financial Literacy Strategy

During the preparatory phase of the National Financial Literacy Strategy, mechanisms for consultation, coordination and information exchange among the various stakeholders were applied. This ensured that the experiences of Austrian stakeholders from the public, private, and nonprofit sectors were influential in the strategy and that Austria-specific needs were taken into account when developing the strategy's goals and action plan.

Online stakeholder consultation

Through a broad-based national stakeholder consultation (June-September 2020), stakeholders were able to have their say. With their experience, competence and commitment to financial education, it was possible to achieve an initial stocktaking regarding the financial education landscape in Austria. A total of 39 institutions were involved, with experience from over 90 financial education initiatives.

Virtual Workshop

On October 20, 2020, a virtual workshop was held, consisting of representatives who had previously participated in the stakeholder consultation, Organization for Economic Cooperation and Development (OECD) and European Commission experts, as well as international delegates from the International Network for Financial Education (OECD/INFE). At this stakeholder workshop, focused working sessions were held on the following topics:

- Defining financial education together

- Financial education at different life stages and for new vulnerable groups

- New competencies for future-oriented financial topics in line with consumer protection

- Reaching target groups: effective communication, implementation and visibility of the strategy

- Formal education: schools, teacher training and curriculum development

- Long-term financial stability: saving, investing and planning for the future

Erstellung des Mapping-Berichts

Ausgehend von den im Rahmen der Stakeholderkonsultation sowie im Stakeholder Workshops gelieferten Inputs, Sekundärerhebungen und den verfügbaren Finanzbildungsdaten (OECD, 2020) wurde gemeinsam mit der OECD ein Mapping-Bericht erarbeitet. Der Mapping Bericht gibt einen Überblick über das Niveau an Finanzbildung in Österreich und den Ist-Zustand der Finanzbildungslandschaft und wurde als Basis für die Erarbeitung der konkreten Ziele und Maßnahme herangezogen.

e3-Lab Challenge zur Ideengenerierung

Mit der Co-Creation Plattform des Finanzministeriums, dem e³lab, wurde eine Online Ideen-Challenge zum Thema Finanzbildung abgehalten, um Inputs und Ideen junger Menschen zu sammeln. Schülerinnen und Schüler sowie Jugendliche außerhalb der Schule konnten von Jänner bis Ende März 2021 ihre Ideen und Überlegungen zur Vermittlung von Finanzbildung sowie zur Nationalen Finanzbildungsstrategie einbringen, die in weiterer Folge auch in den Strategieerarbeitungsprozess eingeflossen sind.

Strategieerarbeitung auf Basis des Mapping-Berichts und weiteren vier Workshops

Bei der konkreten Ausarbeitung des nationalen Strategiedokuments und Aktionsplans wurden die Stakeholder aus dem Bereich Finanzbildung abermals konsultiert. Aufbauend auf den Empfehlungen des Mapping-Berichts arbeiteten OECD und BMF Entwürfe für die Ziele und Maßnahmen aus, die in der Nationalen Strategie verankert werden sollten. Diese Ziele und Maßnahmen wurden im Rahmen von vier online Workshops, die im April und Mai 2021 unter dem Vorsitz des BMF stattfanden, mit den Stakeholdern diskutiert, verfeinert und ergänzt. Es fanden Arbeitsgruppen zu den folgenden Themen statt: (1) Basisfinanzbildung, (2) Kapitalmarktwissen, (3) Zukunftsvorsorge (4) Bewusstseinsbildung.

Nationale Finanzbildungsstrategie: Konkrete Ziele mit integrativer Governance

Gemündet hat die gemeinsame Erarbeitung der Strategie in u.a. 41 Action Tools, die zwischen 2021 bis 2026 adressiert werden sollen, und in eine integrative Governance Struktur, die von unterschiedlichen Institutionen mit einem breiten Themenspektrum getragen wird.

Im Entscheidungsgremium Finanzbildungsrat finden sich daher das Bundesministerium für Finanzen genauso wie das Bundesministerium für Soziales, Gesundheit, Pflege und Konsumentenschutz, das Bundesministerium für Bildung, Wissenschaft und Forschung sowie die Oesterreichische Nationalbank.

Im Beratungs- und Expertengremium Steuerungsausschuss finden sich – neben den Institutionen des Finanzbildungsrats – Institutionen, die spezifische Interessen einer bestimmten Anzahl an Mitgliedern vertreten und ein aktives Interesse am Thema Finanzbildung haben oder nicht gewinnorientierte Finanzbildung betreiben. Mitglieder sind die Bundesarbeiterkammer Österreich, das Bundeskanzleramt – Sektion Frauen und Gleichstellung, das Bundesministerium für Digitalisierung und Wirtschaftsstandort, das Bundesministerium für Klimaschutz, Umwelt, Energie, Mobilität, Innovation und Technologie, das Bundesministerium für Landwirtschaft, Regionen und Tourismus, der Dachverband der Schuldnerberatungen in Österreich, das Institut für Höhere Studien, die Industriellenvereinigung, die Österreichische Finanzmarktaufsicht, das Umweltbundesamt, die Universität Innsbruck, die Universität Wien, die Wirtschaftskammer Österreich Bildungpolitik & Bundessparte Banken und Versicherung und die Wirtschaftsuniversität Wien.

Creation of the mapping report

Based on the inputs provided in the stakeholder consultation as well as in the stakeholder workshops, desk research and available financial education data (OECD, 2020), a mapping report was developed jointly with the OECD. The mapping report provides an overview of the level of financial education in Austria and the current state of the financial education landscape and was used as a basis for the development of the concrete goals and measures.

e3-Lab Challenge for idea generation

With the co-creation platform of the Federal Ministry of Finance (MoF), the e³lab, an online idea challenge on the topic of financial education was held to collect inputs and ideas from young people. From January to the end of March 2021, pupils and young people outside of school were able to contribute their ideas and reflections on the teaching of financial education and on a future National Financial Literacy Strategy, which were subsequently also incorporated into the strategy development process.

Strategy development on the basis of the mapping report and four further workshops

Stakeholders from the financial education sector were again inquired in the actual creation phase of the national strategy document and action plan. Building on the recommendations of the mapping report, the OECD and MoF prepared draft objectives and measures to be anchored in the National Strategy. These objectives and measures were discussed, refined and supplemented with stakeholders during four online workshops chaired by the MoF in April and May 2021. Working groups were held on the following topics: (1) Basic financial education, (2) Capital market knowledge, (3) Provision for the future (4) Raising awareness.

Four main policy priorities of the Strategy

The strategy’s vision will be achieved by coordinated actions of Austrian stakeholders towards the achievement of four policy priorities. These have been selected based on quantitative evidence and on qualitative information gathered through a comprehensive dialogue among public, private and non-profit stakeholders throughout the preparatory phase of the strategy. They are:

• Develop sound financial decision making early in life and prevent over-indebtedness

• Promote responsible financial planning for long-term financial well-being

• Raise awareness on the importance of financial literacy and ensure access to quality financial education for all

• Increase the effectiveness of financial literacy initiatives through dialogue, coordination and evaluation.

They are complemented by three crosscutting priorities: supporting gender equality and the adoption of a gender angle in all the strategy’s initiatives, providing people living in Austria with the knowledge and skills required to profit from the digitalisation of retail financial services, and helping consumers make sustainable financial choices.

These crosscutting priorities should be considered in the design and delivery of the action tools of the National Strategy as well as in the establishment of new initiatives in the field of financial literacy. The strategy’s roadmap provides further details on these priorities, and selects for each of them relevant second-level objectives and action tools to support their implementation over the period 2021-2026.

The strategy focuses on the whole population in Austria, thereby recognising that there are target audiences that, based on their existing or potential vulnerabilities, or on specific financial literacy needs, require additional resources and tailored support. Their needs will be taken into account in the design of financial literacy initiatives, and they should be targeted in particular at key life stages in which they are more likely to require access to relevant information, and support. The priority target groups are children and young people, age 6-19, attending schools in the Austrian educational system, young people outside of schools and young adults (14-mid 20s), women, working adults and small entrepreneurs and (potential) retail investors. The needs of other target groups are taken into account within the framework of the measures planned for the entire population.

The strategy therefore identifies the following eight life stages in which citizens are to be supported with concrete financial education initiatives: school, further education, first job, working life, first major purchase, planning for the future, family life and enjoying senior years.

Inclusive governance structure

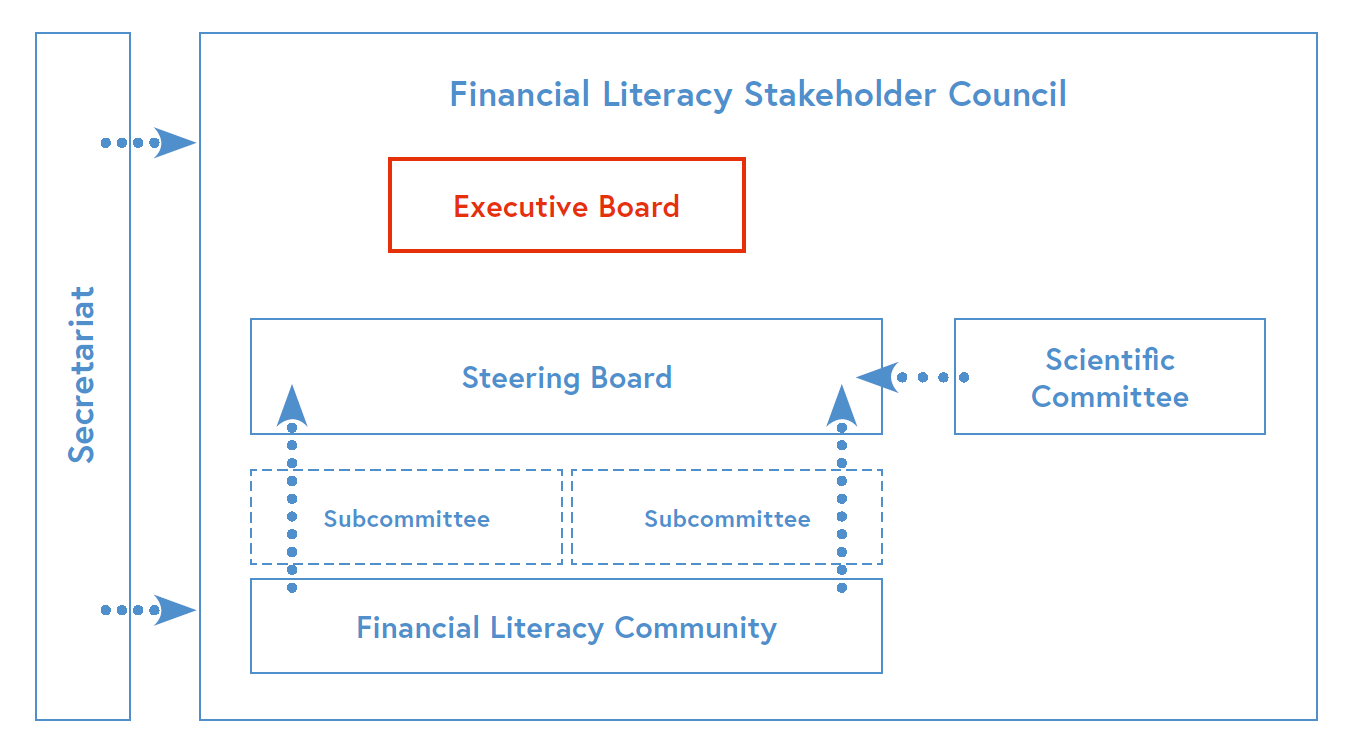

The strategy defines a transparent governance structure that identifies leadership roles, assigns clear executive and supervisory responsibilities over the whole strategy, supports institutionalised cooperation and provides for permanent instances of dialogue among financial literacy stakeholders and interested parties within Austria.

It establishes a leading body with executive, supervisory and advisory functions, the Financial Literacy Stakeholder Council, supported by a Secretariat. The Stakeholder Council is comprised of an Executive Board, a Steering Board, a permanently established Scientific Committee, and a Financial Literacy Community, with the possible creation of thematic Sub-Committees.

- The Executive Board has executive and supervisory functions over the whole strategy and is the ultimate decision-making body within the strategy.

- The Steering Board ensures the permanent representation of Austrian citizens, consumers, private sector and of the research community, through the presence of ministries and public institutions, debt counselling and labour organisations, key private sector associations and academia.

- The creation of a permanently established Scientific Committee ensures the contribution of the research community to the design and the implementation of the strategy.

- Additionally, permanent or temporary Sub-Committees can be established with representatives from the Steering Board and the Financial Literacy Community. They can be a source of expertise and experiences in important thematic areas and address specific operational needs of the strategy.

- The strategy also creates a Financial Literacy Community, gathering all Austrian institutions that are active in the field of financial literacy and have an interest in contributing to the national strategy. Through the Financial Literacy Community, the strategy enshrines the values of co-operation and shared values in its foundations.

Roadmap to guide the implementation of the strategy

The roadmap of the National Financial Literacy Strategy defines a framework for implementation for the period 2021-2026. The roadmap:

-

describes the key life stages and the priority target audiences that have been identified to guide the strategy’s implementation

-

explains how the strategy will achieve progress in its four main policy priority areas (see Four main policy priorities) and the crosscutting priorities, through a description of second-level objectives and of the action tools that can contribute to their achievement.

The roadmap will be complemented by annual action plans to be approved by the Executive Board following consultation with the Steering Board of the Financial Literacy Stakeholder Council. The annual action plans will identify projects to be undertaken over the year - building on the action tools presented in the roadmap-, will assign operational responsibilities to members of the Steering Board and could include budgetary commitments.

The policy priorities of the National Strategy are long-term in nature and not all of them will be fully achieved by 2026. The National Strategy will be revised after a period of five years, to assess progress made, learn from implementation, reflect changes in financial markets and society and ensure its continued relevance in meeting the financial literacy needs of the Austrian population.

1st Executive Board meeting

The Executive Board, responsible for supervision and decision making of the National Strategy, had its first meeting on 25th of January 2022. The representatives of the Federal Ministry of Finance (BMF), the Federal Ministry of Education, Science and Research (BMBWF), the Federal Ministry of Social Affairs, Health, Care and Consumer Protection (BMSGPK) and the Oesterreichische Nationalbank (OeNB), jointly passed resolutions on important documents and topics for the further joint work to implement the National Financial Literacy Strategy – the Annual Working Plans 2022 & 2023, the Rules of Procedure and the Code of Conduct of the National Strategy as well as the election of the OeNB as co-chairman of the Steering Committee.