Excerpts from the Register

Find out how simple and extended excerptsfrom the register are correctly interpreted, and how they will help you to meet the due diligence obligations for prevention of money laundering and terrorist financing.

General

The primary purpose of the Register of Beneficial Owners is prevention of money laundering and terrorist financing. Accordingly, the excerpts from the register have been designed in such a way that they will significantly facilitate identification and verification of the beneficial owners of customers of obligated parties.

In the case of customers with a domestic corporate structure who have a low and medium money laundering risk, it will in future be possible to determine and verify the beneficial owners on the basis of a complete extended excerpts from the register. In many such cases, it will be possible to identify and verify the beneficial owners of a client/customer during an initial meeting. This will affect a large proportion of the customers of companies that are obligated to carry out due diligence obligations (obligated parties). Moreover, the measures implemented to verify completeness and appropriateness will significantly improve the quality of the information on the beneficial owners of your customers as determined by the obligated parties.

In the future, obligated parties will be able to retrieve two different officially signed excerpts from the register via the Business Service Portal of the Federal Government:

- Simple excerpts according to § 9 IV of the BORA

- Extended excerpts according to § 9 V of the BORA

Simple excerpts

Simple excerpts provide a solid overview of the beneficial owners of a legal entity. They comprise general information such as name and legal form as well as addresses and master register numbers (for example company register number) and enable the economic activity to be identified on the basis of the ÖNACE Classification (for example, C13.20-0 Weaving). In addition, all data on direct and indirect owners are included, including the nature and extent of the beneficial interest.

Examples of simple excerpts from the register:

- Simple excerpts of a limited company exempt from registration (PDF, 242 KB)

- Simple excerpts of a simple multi-level structure with reported beneficial owners (PDF, 243 KB)

Extended excerpts

Extended excerpts

The extended excerpts additionally comprise the following information beyond the data in the simple excerpts :

- whether the excerpts is a complete extended excerpts ; this is the case if all the data are available in full, the reported data correspond to the data generated semi-automatically, and there is no notice in force

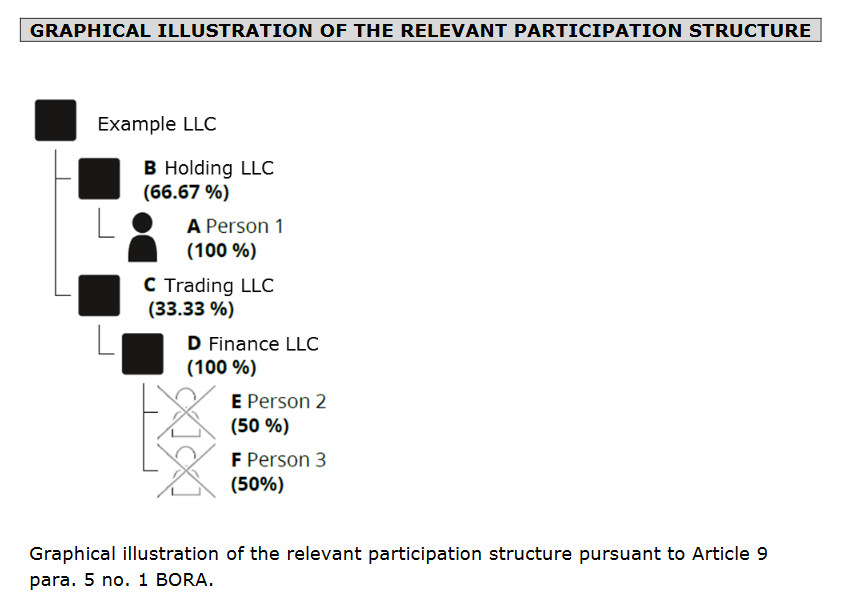

- Presentation of the relevant investment structure, which is calculated on the basis of data from the register of companies

- Calculated beneficial owners and top-level legal entities calculated on the basis of data from the register of companies, the register of associations and the supplementary register

Example of a semi-automatically generated representation of the relevant investment structure:

Examples for extended excerpt from the Register:

- Complete extended excerpt regarding a legal entity that is exempt from reporting (PDF, 273 KB)

- Complete extended excerpt regarding a legal entity that is exempt from reporting (with explanations) (PDF, 831 KB)

- Complete extended excerpt regarding a basic multi-level structure with reported beneficial owners (PDF, 305 KB)

- Complete extended excerpt regarding a basic multi-level structure with reported beneficial owners (with explanations) (PDF, 1 MB)

- Extended excerpt regarding a legal entity with a complex domestic structure with two private foundations (PDF, 353 KB)

- Extended excerpt with reported trusteeship with a limited liability company that is exempt from reporting (PDF, 263 KB)

The sample excerpts from the Federal Ministry of Finance may be used for training purposes.

Identifying and verifying beneficial owners with the aid of extended excerpts from the register

Companies to which the due diligence requirements for the prevention of money laundering and terrorist financing apply are now obliged to identify and verify the beneficial owners of their customers. This applies to all customers that are not natural persons. If the customer is an Austrian legal entity pursuant to Article 1 para. 2 BORA, the beneficial owners of the customer can be identified and verified with the aid of extended excerpts from the Register. The prerequisites for this for all obliged entities are governed by Article 11 BORA:

- A complete extended excerpt is available. This is the case when the calculated beneficial owners are the same as the reported beneficial owners and no notice in force exists. Example of a complete extended excerpt.

- There are no factors indicating an increased risk.

- The obliged entity has made inquiries of the customer to ensure that there are no control structures or trust relationships that differ from the extended excerpt. These inquiries can also be incorporated into the existing process for establishing business relationships by including this question in the customer questionnaire.

If the obliged entity is convinced that the beneficial owners listed in the excerpt are correct, no additional documents are necessary to verify their identities.

In all the remaining cases, the extended excerpts from the Register are an ideal starting point for identifying the beneficial owners due to the graphic depiction of the relevant levels of participation. In this case, suitable additional measures must be taken to verify the beneficial owners, which, e.g., may consist of excerpts of higher level legal entities.

User fees

Article 17 BORA provides that usage fees shall be charged for inspections of the Register to cover costs. It is possible to pay a flat-rate usage fee for a certain allotment of excerpts or to pay an individual charge for each excerpt. The amount of the usage fee was established by the Regulation of the Federal Minister of Finance establishing fees for the use of the Register of Beneficial Owners (BORA Usage Fees Regulation), Federal Law Gazette II 77/2018:

Individual charges

With individual charges, the fee for accessing each individual excerpt is paid in advance. For one excerpt, the fees are as follows:

| Simplified excerpt (Article 9 para. 4 BORA) | EUR 4.00 |

| Extended excerpt (Article 9 para. 5 BORA) | EUR 5.00 |

| Extended excerpt with Compliance-Package (Article 9 para. 5a BORA) | EUR 10.00 |

| Excerpt with legitimate interest (Article 10 BORA) | EUR 4.00 |

| Excerpt via the intereconnectio beneficial owner registers (BORIS) | EUR 5.00 |

Flat-rate user fee

As an alternative to the individual fee, obliged entities can also pay a flat-rate usage fee pursuant to Article 9 para. 1 BORA. There are five different fee categories, which each entitle the user to a different number of excerpts.

The following allotments are available:

| 15 simplified or extended excerpts | EUR 70 |

| 50 simplified or extended excerpts | EUR 220 |

| 250 simplified or extended excerpts | EUR 1,050 |

| 750 simplified or extended excerpts | EUR 3,000 |

| 2.500 simplified or extended excerpts | EUR 9,500 |

| 7.500 simplified or extended excerpts | EUR 27,000 |

The flat-rate user fee entitles the user to call up the excerpts included in the quota within one year of applying for the flat rate. After the end of the annual utilisation period, any unused quota may no longer be used. If a new quota is applied for, any unused quota is automatically transferred to it and can continue to be used (§ 2 III of the BORA Usage Fees Regulation).

One month before the end of the current period of use or when at least 85 percent of the quota has been used up, a notification will be sent. After receipt of this letter, a new flat rate can already be concluded. In this case, the new usage period begins when the current usage period ends due to time lapse, or the included quota is completely used up, depending on which case occurs earlier.

The purchase of a flat rate, the quota administration, as well as the use of the retrieval function for simple and extended excerpts is done via the WiEReG Management System.

Subscription

In addition, the annual flat-rate user fee can also be paid by subscription. In this case, the desired quota is automatically activated at the end of the annual usage period, or upon consumption of the last query, and the user fee is collected by direct debit.

One month before the end of the current period of use or as soon as 75% of a quota has been used up, a notification will be sent by email, and the subscription can be changed or cancelled at will until a new quota is activated. This change was provided in view of the possibilities now available to integrate the query functionality of the register into the IT systems of obligated parties. This is to ensure that a digital process does not come to a standstill due to exhaustion of a quota. The BORA Usage Fees Regulation, Federal Law Gazette II № 77/2018, most recently amended by Federal Law Gazette II № 437/2019, and the Terms of Use for the Register of Beneficial Owners are relevant for the settlement of user fee.