Budget.gv.at

2026-01-31: Federal budget - preliminary outcome 2025

The consolidation volume in the federal budget 2025 was fully achieved. As a result of strict budgetary execution and more favourable economic conditions, the net financial balance of the federal government in 2025 amounted to €-14.4 billion, which was € 3.7 billion better than expected at the time the budget was prepared.

Improvements in the administrative balance relating to interest payments and tax revenues are, in accordance with EU fiscal rules, not to be counted as deficit-reducing.

The general government deficit encompassing the central government (federal government plus extra-budgetary units), states, municipalities and social securities will be published by Statistics Austria at the end of March 2026.

EU fiscal rules and the new Austrian Stability Pact continue to require budgetary execution across all levels of government and the consistent implementation of all agreed consolidation measures.

Federal budget - preliminary outcome 2025 at a glance: Download (PDF, 295 KB)

Expenditure amounted to € 121.5 billion in 2025 and thus remained € 1.8 billion below the 2025 Budget of €123.2 billion. This was primarily attributable to interest payments and other financial expenses being €1.6 billion lower than budgeted. In cyclical budget areas, higher unemployment in particular led to additional expenditure totalling € 0.3 billion.

Revenue amounted to €107.1 billion and was therefore €2.0 billion above the 2025 budget estimate. This was mainly driven by more favourable economic conditions, in particular gross wage and salaries as well as private consumption grew stronger than assumed. Gross tax revenues exceeded the budget by €2.3 billion, around half of which was due to higher revenue from capital gains taxes. Accordingly, tax revenue shares of the states and municipalities were also higher than budgeted.

Owing likewise to higher gross wages and salaries, contributions to unemployment insurance and to the Family Burden Equalisation Fund each exceeded the budget by € 0.1 billion.

These additional revenues were offset by lower cash inflows resulting from payment shifts in EU agricultural/fisheries funds and the EU Structural Funds, amounting in total to € 0.5 billion.

2025-12-23: 2025 Long-term Fiscal Projection

Pursuant to Section 15(2) of the Federal Budget Act 2013, the Federal Minister of Finance is required to prepare, every three years, a well-grounded and transparent long-term budgetary projection covering a period of at least 30 years. This report is the fifth of its kind and is based on a study conducted by the Austrian Institute of Economic Research (WIFO), commissioned by the Federal Ministry of Finance (MoF).

The 2025 edition is characterized by the impact of the COVID-19 pandemic, the energy crisis, the inflation surge and the economic downturn on public finances, as well as the subsequent phase of budget consolidation. Overall, the results clearly demonstrate how necessary it was for the Federal Government to initiate budget consolidation, and how important it is to continue this consolidation effort.

As in the 2022 Long-term Budgetary Projection, this report includes an assessment of the fiscal implications of climate change and climate policy measures. For this purpose, a climate module was again developed in cooperation with the Environment Agency Austria (Umweltbundesamt).

The 2025 Long-term Fiscal Projection is fully available in English: Download (PDF, 2 MB)

2025-11-03*: Public Finance 2025 & 2026 - Update Autumn 2025

* Publication date of the English version, figures are as of 15 October 2025

Report on Effective Action to Correct the Excessive Deficit (PDF, 758 KB) (unofficial English version of the report in German)

Budget is on track

The budget consolidation is on track. The general government deficit is expected – according to current forecasts – to be at the planned 4.5% of GDP in 2025. The figures for the central government sector are developing more favourably than assumed in the budget estimate, the figures for the states and municipalities and for social security somewhat less favourably, such that overall the targets can be met. On balance, the central government can compensate the figures on the part of the states, municipalities and social security.

Despite a deterioration of the Maastricht‐balance in 2025 by € 1.0 bn. to €-23.2 bn., the deficit target will be met. This is due to the higher nominal gross domestic product (GDP), which also has a positive effect on the debt ratio. It is now estimated at 81.7% of GDP in 2025, i.e., 3.0 percentage points lower than estimated in spring.

In addition to better economic conditions, strict budget execution and the consolidation measures – which to a large extent will come fully into effect in the second half of this year – are the main reason for the achievement of the specified goals.

According to the forecasts, Austria will also remain on the planned consolidation path next year. The general government deficit is expected at 4.2 % of GDP in 2026. The breakdown of the deficit will shift somewhat, however, because the central government will – unlike in May 2025 when 3.5 % of GDP was assumed – perform better at 3.2 % of GDP, while the states and municipalities and the social security will perform somewhat worse.

The improvements in the federal budget are primarily due to the consolidation measures taken, the strict execution and the slightly improved economic data. Despite lower expenditures and improved revenue shares, which yield additional revenues of about € 450 mn. in 2025 and about € 230 mn. in 2026 for states and municipalities (compared to the time of the budget preparation for the double-budget 2025/26), a deficit of the states and municipalities of 0.9 % of GDP is currently assumed for 2026 – i.e., 0.2 percentage points worse than assumed in May 2025.

2025-05-13 Budget draft 2025 and 2026 has been tabled

With the Budget 2025/2026 and the Medium-Term Expedntirue Framework until 2029,the Federal Government is starting the consolidation of public finances and achieving the budgetary turnaround in a difficult environment.

At the general government level, € 6.4 billion will be consolidated in 2025 and € 8.7 billion in 2026. This will reduce the Maastricht deficit to 4.5% of GDP in 2025 and 4.2% in 2026. Without consolidation, the deficit would have risen to 5.8% of GDP in 2025 and 5.9% of GDP in 2026. In 2028, the Maastricht deficit will be reduced to 2.98% of GDP, just below 3.0% of GDP.

The consolidation measure are sufficient to stabilise the increase in the debt ratio. A debt ratio of 84.7% of GDP is forecast for 2025 and 86.2% in 2026. By 2028, there will only be a slight increase to 87.0%. The debt ratio will then fall again for the first time in 2029.

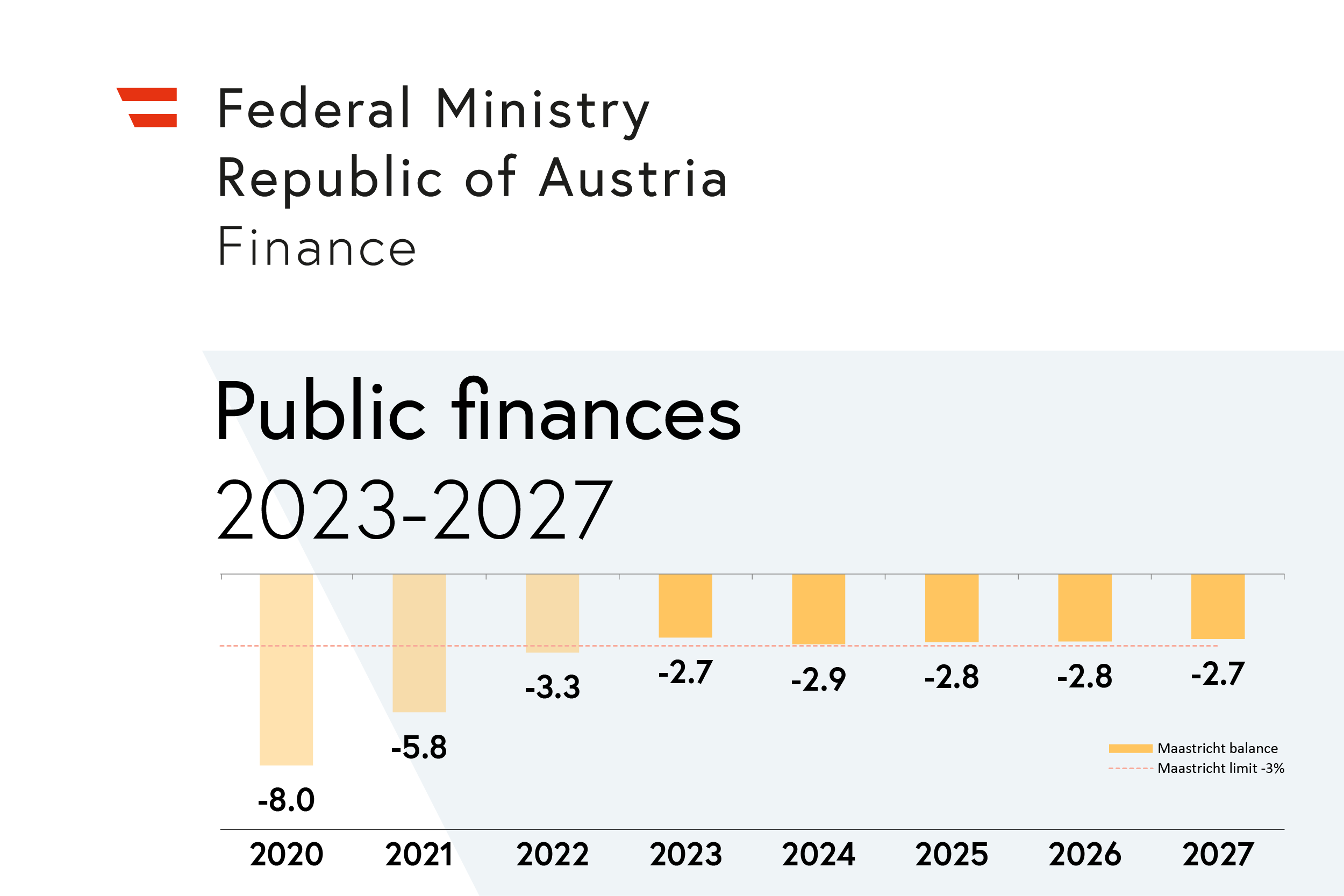

2024-04-30 - Economic Developments and Public Finances 2023-2027

According to the notification by Statistics Austria in March 2024, the general government Maastricht balance for 2023 amounts to Euro -12.7 bn or -2.7% of GDP. Compared to 2022, this is an improvement of Euro 2.0 bn or 0.6 percentage points. This means that the Maastricht deficit limit of 3.0% of GDP was met in 2023 for the first time since 2019 and the COVID-19 and energy crisis.

This budget policy course will also be maintained in the coming years. A Maastricht balance of Euro 14.6 bn or -2.9% of GDP for 2024 is forecast by the MoF, followed by a slight decline to -2.8% of GDP in 2025 and 2026 and to -2.7% of GDP in 2027.

The Maastricht debt level amounted to Euro 371.1 bn at the end of 2023, while the debt ratio in relation to GDP was 77.8% of GDP (-0.6 percentage points compared to 2022). A further slight decline in the debt ratio to 77.5% of GDP is forecast for 2024, followed by an almost constant debt ratio until the end of the forecast period in 2027.

2024-03-28 - Preliminary cash results 2023

Report pursuant to § 47 (2) and (2a) Federal Budget Act 2013

The provisional net financing balance of the federal government amounted to € -8.0 bn (deficit) in 2023 and is therefore € 9.1 bn better than planned in the federal budget for 2023.

The lower expenditure compared to the budget of € 6.0 bn (-5.2%) results from lower expenditure related to the energy crisis (€ -0.7 bn), for COVID-19 crisis management (€ -0.1 bn), underruns of the budget 2023 due to the economic situation (€ -0.2 bn), lower interest payments (€ -1.0 bn) and other lower budget requirements (€ -4.0 bn, e.g. investment premium, green transition, Export Guarantee Act, federal staff in the education sector).

The higher revenue of € 3.1 bn (+3.2%) is mainly due to the economic situation (€ +2.3 bn, of which gross taxes € +1.1 bn), but is also attributable to higher cash inflows from dividends and the liquidation of immigon AG, for example.

2023-11-23 - Budget 2024-2027

The 2024-2027 budget clearly shows the medium to long-term challenges facing our society: demographic change (pensions, health and care), security and dealing with climate change. Financing costs will double from 0.9% to 2.0% of GDP between 2022 and 2027.

These challenges, the investments in the future of Austria as a business location and the relief measures are therefore also reflected in the 2024 to 2027 budget path.

The federal deficit amounts to €20.9 billion in 2024 and will fall to €16.9 billion by 2027. Despite the budgetary burdens, the general government Maastricht deficit will remain below 3.0% of GDP from 2024 to 2027. The public debt ratio will remain stable or decline to below 77% of GDP by the end of the planning period in 2027